Services

Online Valuation

We can provide a valuation for your item ONLINE. Please fill out the form and send us a photo or photos and a brief item description of the item you wish to have examined.

We can provide a valuation for your item ONLINE. Please fill out the form and send us a photo or photos and a brief item description of the item you wish to have examined.

This is a VALUATION only. It is not a formal Appraisal Report. If you wish to have an

Appraisal Consultation please email: [email protected]

or call 305 798-0308

Click HERE to fill out the form and Pay via PayPal $ 50.00

Estate Appraisals

An Estate Appraisal is required to determine the value of all Tangible Assets at the time of the decedent's death. In other words, the appraiser has to research for what prices would have been at that time. The appraisal has to specifically state that the values given are as of the date of death of the estate's owner. Furniture, antiques, collectibles, silverware, china, crystal, fine arts, automobiles and any other items of personal property are inventoried, photographed & evaluated for appraisal value. Condition and demand for items influence the appraised values. Again, these values must be determined as of the date of death of the owner of the estate.

Appraisals for Probate

Estate and Probate Appraisals comply with the standards and guidelines put forth by the Federal Treasury Regulations and the Internal Revenue Service.

Equitable Distribution Appraisals

Equitable Distribution Appraisals, which are based on Fair Market Value, are often used for distributing property in divorce settlements. Values are determined according to USPAP standards and ISA guidelines. This type of document can also benefit clients wishing to distribute antiques and artwork among their children or distribute to various heirs of an estate.

Charitable Donation Appraisals

The IRS requires submission of Form No. 8283 for Non-Cash Charitable Donations in excess of $500. This form is filled out by a personal property appraiser along with their appraisal report. For donors who are gifting items to a non-profit organization, the IRS requires the donor to obtain a qualified appraisal of the items being donated. In addition, the IRS now requires the appraiser to meet the provisions of the Pension Protection Act of 2006. As Accredited Members of the International Society of Appraisers, we meet and exceed the requirements outlined by the IRS for charitable donation appraisals of artwork. In addition, we complete the 8283 form at the time of your appraisal which is submitted with your tax filing.

Business or Partnership Dissolution / Marriage Dissolution - Divorce Appraisals

In the event of the dissolution of a marriage, partnership or business there are many questions that come up in regards to ownership and proper division of personal property or other assets. It is extremely helpful to have an appraisal to assist the various parties to agree as to the division of property, or the court in coming up with a settlement.

In the event of the dissolution of a marriage, partnership or business there are many questions that come up in regards to ownership and proper division of personal property or other assets. It is extremely helpful to have an appraisal to assist the various parties to agree as to the division of property, or the court in coming up with a settlement.

Insurance Claims / Loss or Damage Personal Property

Appraisals for Insurance Coverage

Valuable purchases such as artwork, collectibles, period furniture and design objects which have appreciating values and must be insured. Also homeowners insurance coverage sometimes calls for an appraisal of personal property to come up with premium pricing

Bankruptcy Appraisals

In the event of a bankruptcy, the court may need the value of the personal property assessed in order to determine the worth of the individual(s) filing for bankruptcy.

In the event of a bankruptcy, the court may need the value of the personal property assessed in order to determine the worth of the individual(s) filing for bankruptcy.

Guardianship Appraisals

Used to determine the valuation of an estate to assist in guardianship costs

Liquidation of Personal Property Appraisals

Personal property is all movable furniture, fixtures, machinery, farm equipment and supplies used by an individual, partnership, corporation, or association that own or possess personal property.

Many types of personal property are exempt from taxation. These include household goods and personal effects for personal home use. However, such items, if used in a business, would be eligible for assessment and taxation. Other personal property exempt from taxation includes: custom software, livestock, inventories held solely for resale, motor vehicles licensed for road use, and intangible personal property.

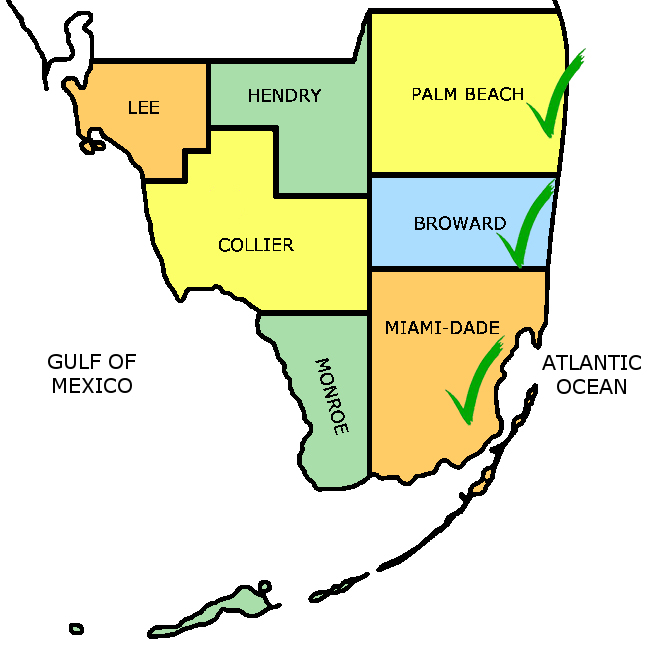

Areas Covered in South Florida